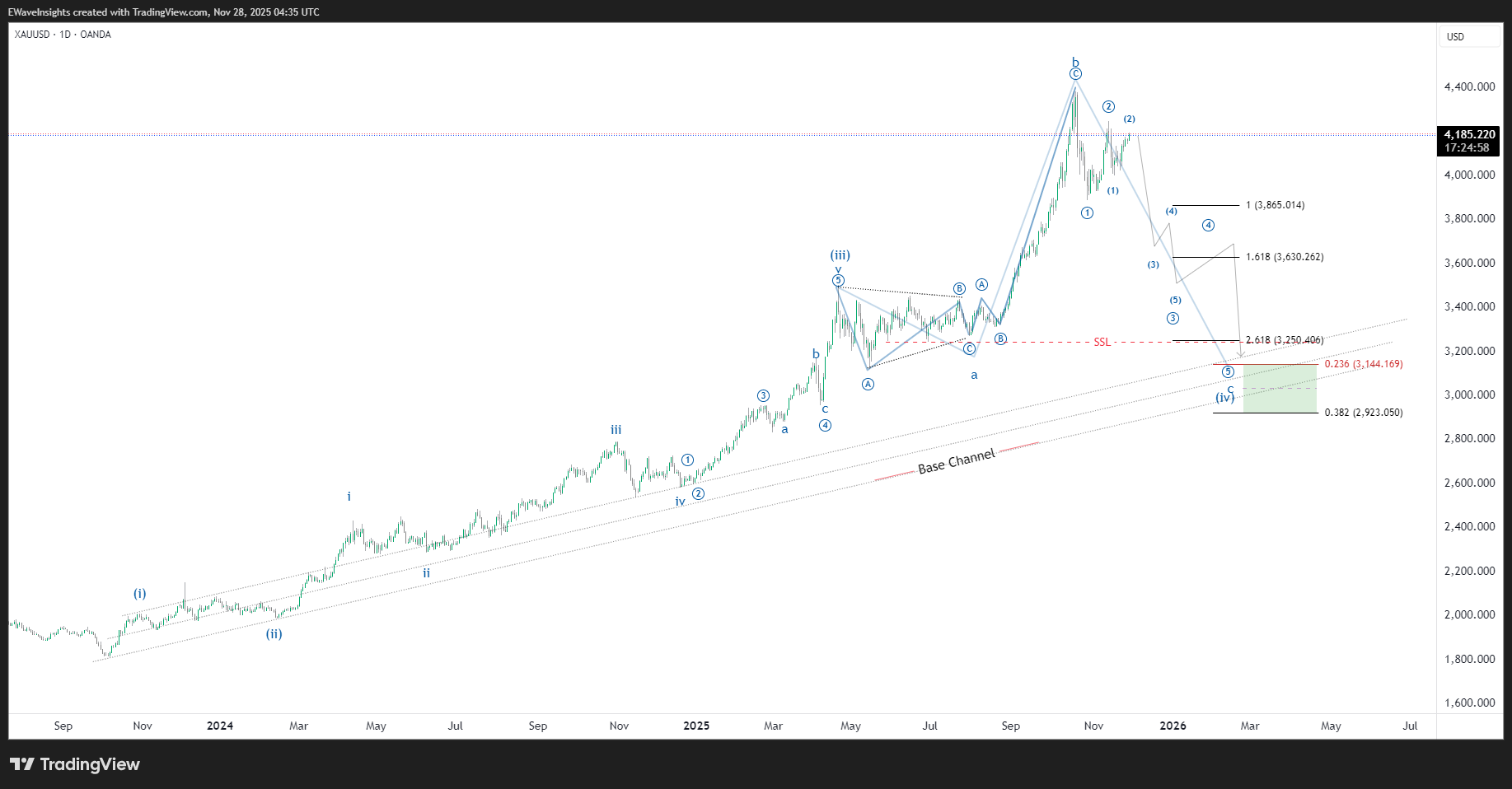

Gold continues to trade near all‑time highs, but the larger Elliott Wave structure suggests the market may be building a major expanding flat before a deeper correction unfolds. The current advance fits best as a terminal move within a higher‑degree wave (3), with price stretching above the prior peak into the wave b high at 4,381.27 before sellers began to respond.

Higher time frame structure

On the daily chart, the impulsive rally from the base channel has already delivered a strong five‑wave advance, with wave (iii) extended and followed by a broad, overlapping correction. That correction is counted as an expanding flat: wave A down, wave B breaking to a new high at 4,381.27, and a still‑developing wave C decline projected to unfold next. Momentum has already started to diverge against price on this last leg, consistent with a maturing B‑wave blow‑off.

Key levels and Fibonacci projections

Fibonacci projections from the prior swing outline a downside roadmap once this flat completes. The 2.618 extension clusters near 3,250, aligning with prior structure and channel support. A broader demand zone then spans roughly 3,140 down toward 2,920, where a 0.382 retracement of the entire advance meets the rising base channel. A more extreme capitulation scenario would open the door toward the 4.618 extension in the 2,490 region.