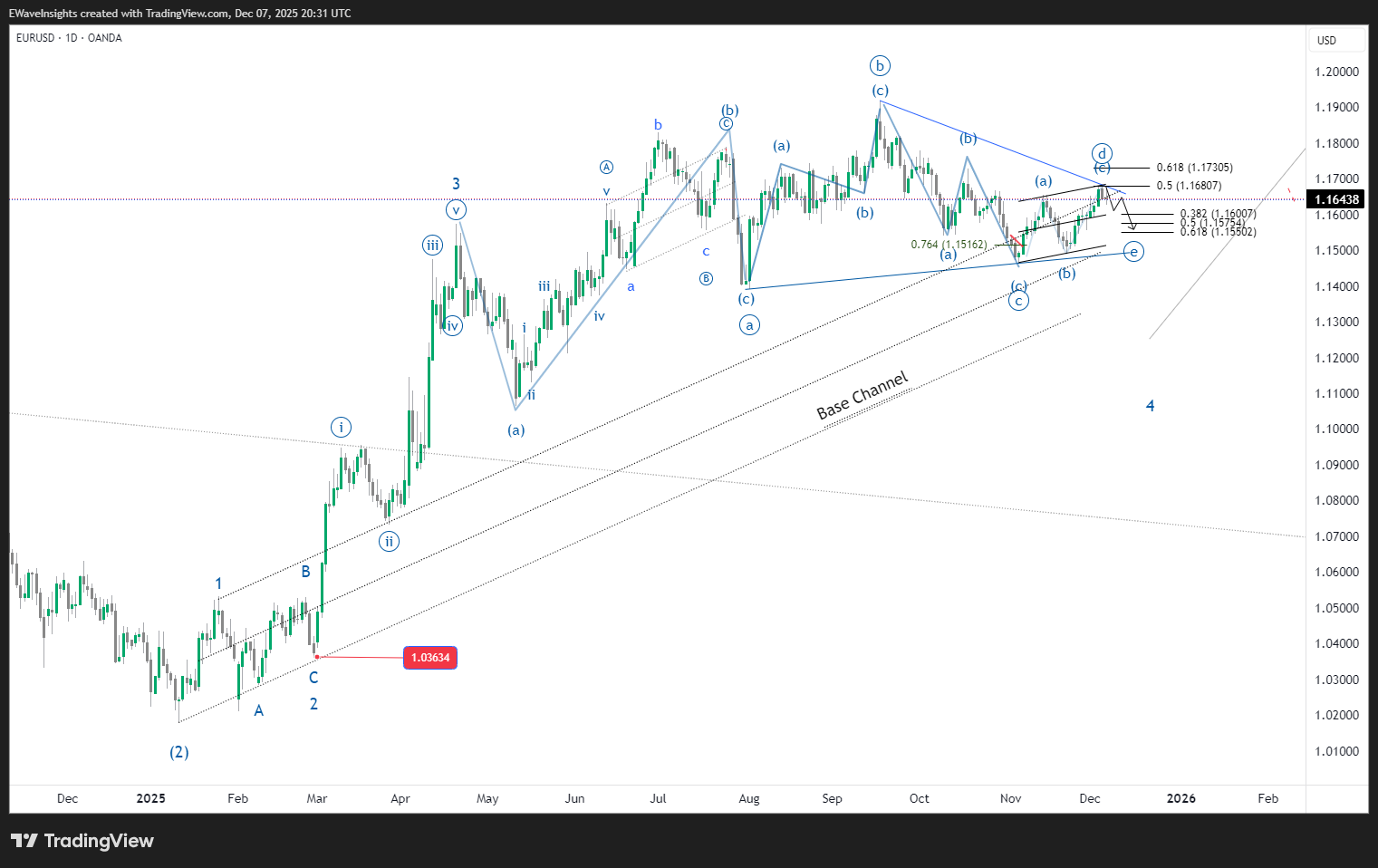

EURUSD Elliott Wave Analysis continues to favor a bullish higher timeframe bias while the Wave 4 contracting triangle structure holds above the base channel. Price action has likely completed wave d of the triangle, and the current focus is on wave e developing lower into the key Fibonacci support cluster at the 0.382, 0.5, and 0.618 retracement levels. This zone is where the correction is expected to complete before the next impulsive advance.

Current Structure

On the daily chart, EURUSD is tracing out a classic Wave 4 triangle, with each leg subdividing correctly and volatility compressing as the pattern matures. Wave d has tested upper resistance, and attention now shifts to wave e, which typically terminates near the triangle’s lower boundary and often aligns with Fibonacci supports taken from the prior Wave 3 advance. This confirms the integrity of the EURUSD Elliott Wave Analysis and keeps the broader uptrend intact.

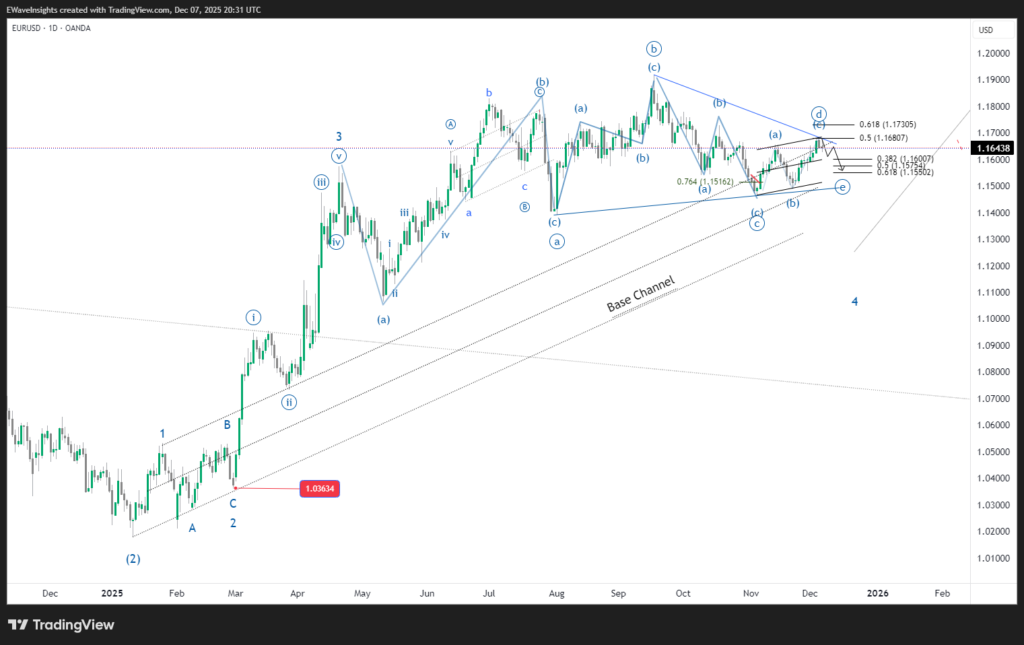

4‑hour view: identifying waves ((c)) and ((d))

On the 4‑hour timeframe, the EURUSD Elliott Wave analysis marks wave ((c)) completing at 1.14697 after a sharp three‑wave decline that tagged both the lower triangle line and roughly the 0.764 retrace of the prior advance.

From that low, EURUSD advanced in another overlapping three‑wave move and topped at 1.16823 just beneath the descending triangle resistance and close to the 0.5–0.618 retracement zone, a typical termination area for a triangle’s ((d)) leg.

Momentum adds weight to this reading: while price made a marginal new high into 1.16823, 4‑hour RSI failed to register a new high, leaving mild bearish divergence against resistance.

This loss of upside momentum at a key confluence zone fits better with a maturing triangle wave ((d)) than with the start of a sustained impulsive breakout.

Key Levels & Invalidation

The key downside levels for wave e are the 0.382, 0.5, and 0.618 Fibonacci retracements, forming the primary support zone where the Wave 4 triangle is expected to complete. Invalidation of this scenario occurs only on a sustained break below the triangle floor and the base channel, which would suggest that Wave 4 is morphing into a deeper correction rather than a contained triangle. As long as price respects these structural boundaries, the bullish roadmap remains the preferred view.

Elliott Wave Roadmap

- Wave 4 triangle structure is unfolding as expected

- Wave e is projected into the 0.382–0.618 Fibonacci support cluster

- Count stays valid while price trades above the base channel and triangle support

- A clean impulsive breakout from the triangle would signal Wave 5 in progress

- Wave 5 target is the classic triangle thrust objective around 1.20697

Clear structure = clear decisions.