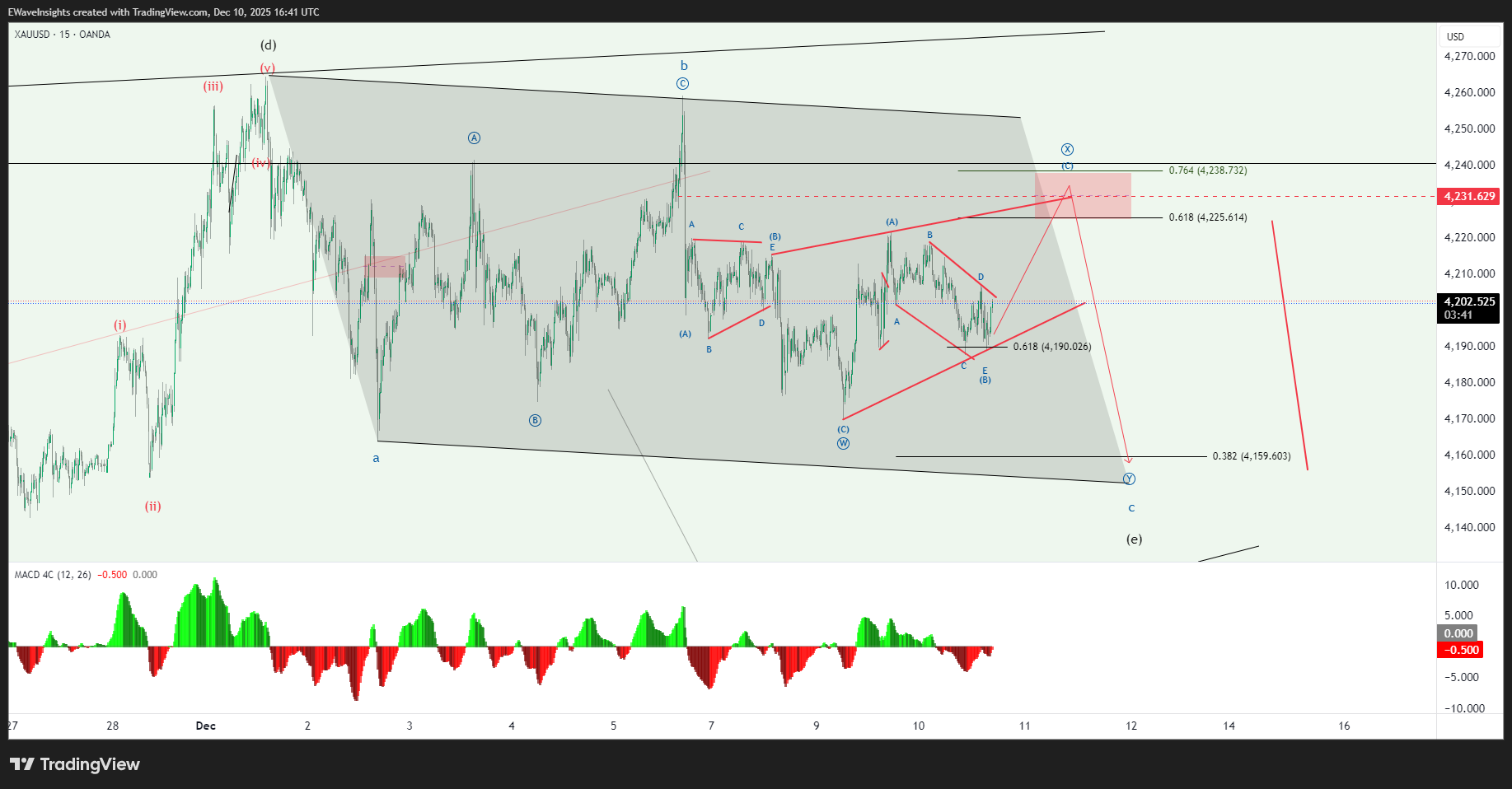

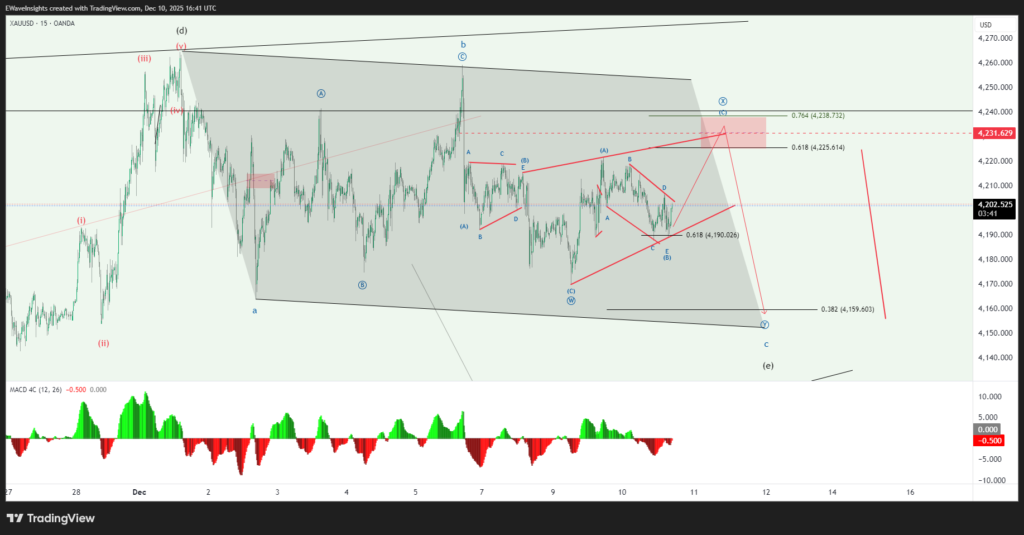

Current Structure

The triangle has formed with clearly defined upper and lower boundaries, with price currently oscillating within the band. The internal swings show diminishing amplitude, classic for a late-stage triangle where volatility is compressing before the next leg. This aligns with textbook Elliott Wave guidelines for wave (iv) or corrective consolidations that often precede wave (v) or impulsive advances.

Key Levels and Setup

The immediate target is the 4,231.791 area, which represents prior swing resistance and the upper edge of the triangle’s projected breakout zone. This level is where traders should watch for confirmation or rejection.

- Bullish confirmation: A clean break and hold above 4,231.791 with follow-through momentum would signal the start of wave (v) the next major impulsive leg higher, targeting the prior wave (iii) highs and upper channel.

- Bearish rejection: If price fails at 4,231.791 and reverses back into the triangle, the focus would shift lower toward prior support zones at 0.618 and 0.5 Fibonacci levels.

Elliott Wave Roadmap

- Triangle consolidation complete or nearly complete

- Watching 4,231.791 for breakout confirmation or rejection

- Above 4,231.791 = bullish wave (v) impulse likely underway

- Below prior low = corrective phase re-forms, downside targets activated

Monitor price action closely at this confluence zone; the next directional decision will become clear once price accepts or rejects 4,231.791.

Clear structure = clear decisions.