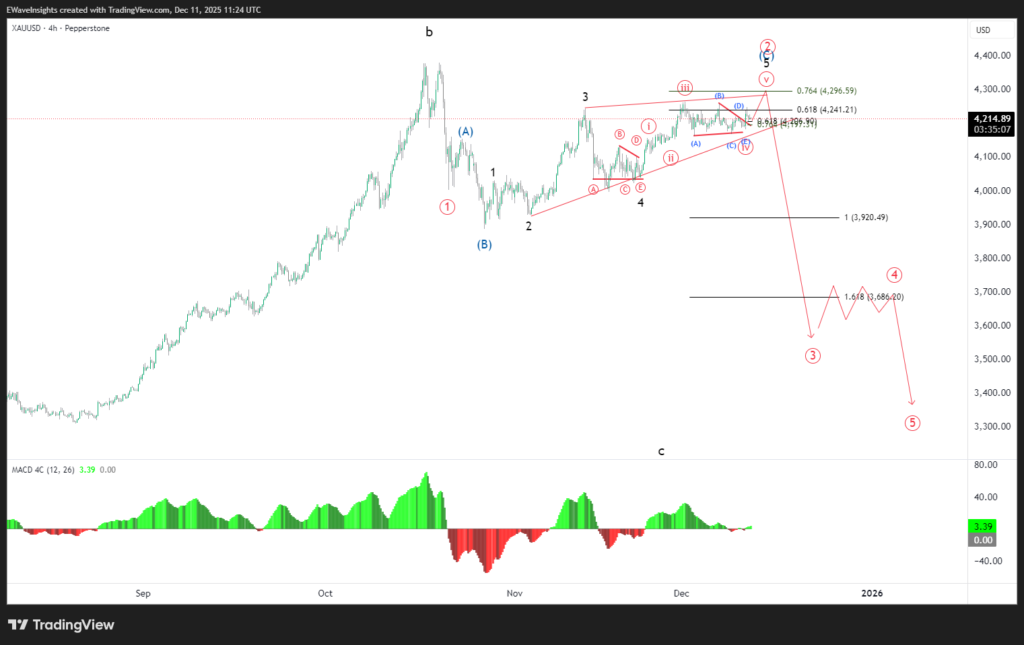

Gold is at a critical technical juncture with two distinct Elliott Wave scenarios playing out:

Bearish: Wave 2 expanding flat finishing at 3,920.49 → Wave 3 down toward 3,600–3,750

Bullish: Wave 4 triangle (E) completing at 4,163.83 → Wave 5 up toward 4,350+

Bullish Scenario

Bullish Scenario

Gold is displaying a textbook contracting triangle on the 4H timeframe with Wave (E) of the correction approaching completion. The setup is now favoring a BULLISH Wave 5 thrust higher once the triangle fully resolves.

The Structure:

- (A) – Initial downleg

- (B) – Bounce/retracement

- (C) – Lower low into triangle

- (D) – Rally into Fibonacci resistance

- (E) – Final compression leg (currently developing)

Bullish Targets:

- Wave (E) completion target: 4,163.83 (0.382 Fib)

- Wave 5 upside target: 4,350–4,400+ (measured-move extension)

- First resistance: 4,231.63 (prior wave resistance)

- Key support (stop): 4,101.57 (0.618 Fib – triangle invalidation floor)

Confirmation signal: Close above 4,231 on 4H + MACD positive divergence

Bearish Scenario

Gold is showing a critical Elliott Wave structure on the 4H timeframe with the broader picture revealing a massive Wave 2 expanding flat correction that’s entering its final stages. Once this structure completes, expect sharp Wave 3 downside acceleration.

Wave 3 downside target: 3,600–3,500 zone (measured-move from Wave 1)