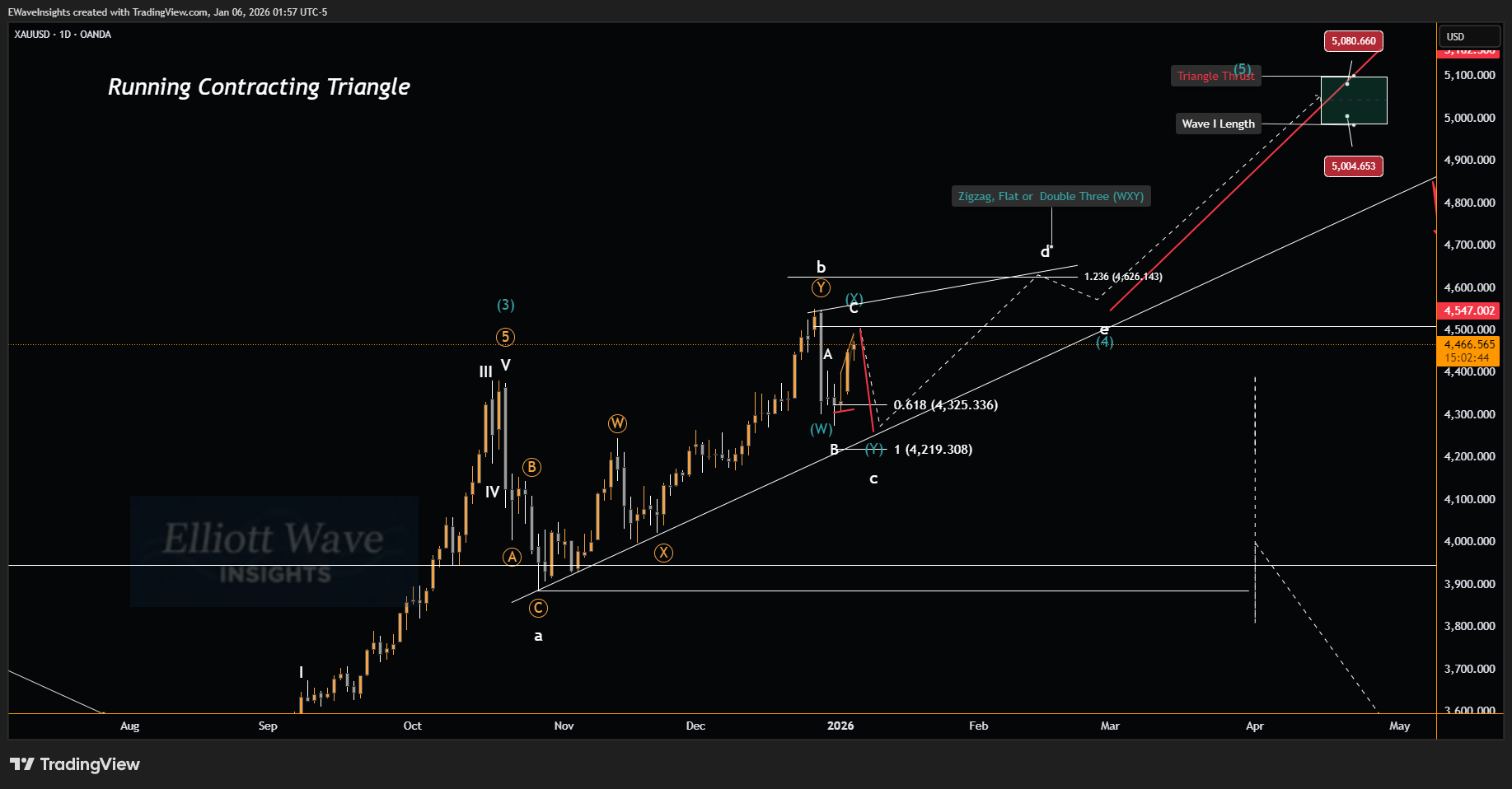

📊 XAUUSD DAILY MARKET ANALYSIS

January 6, 2026 | Daily Timeframe | Running Contracting Triangle

🎯 Market Overview

XAUUSD (Gold)

Daily (1D)

4,547.00

Bullish (Triangle compression phase)

📈 PRIMARY COUNT – RUNNING CONTRACTING TRIANGLE

Pattern: Running Contracting Triangle (Wave C leg)

Structure: Waves I-II-III-IV-V (completed) → Corrective A-B in place → Triangle forming in Wave C

Current Position: Currently IN Wave C of the triangle (contracting with each swing)

Direction: Bullish (Higher Highs & Higher Lows pattern) – compression before breakout UP

Gold completed 5-wave impulse and entered corrective structure. Now in the final triangle compression phase within Wave C. Running triangle behavior shows tightening range with bullish bias (HH/HL). Classic triangle setup: each leg contracts toward apex. Once Wave C completes (likely at or near upper triangle boundary), explosive breakout ABOVE Wave B high expected. This is 4th wave triangle – most bullish signal in Elliott Wave.

🟢 PRIMARY SCENARIO PROBABILITY: 75%

Rationale: Triangle structure confirmed by contracting price range, HH/HL pattern, and wave subdivisions aligning with Fib levels.

⚙️ Triangle Mechanics (Wave A-B-C-D-E)

| Wave | Status | Range / Level |

| Wave A | Completed | Top of Wave B high → initial decline |

| Wave B | Completed | Bounce (HH pattern setting up) |

| Wave C | IN PROGRESS | Contracting down (lower high than Wave A) |

| Wave D | Pending | Bounce (higher high than Wave B – HH pattern) |

| Wave E | Pending | Final leg (lowest point, touches apex) → Breakout UP |

⚡ Alternative Scenarios

ALTERNATIVE 1: EXPANDING TRIANGLE – 15% Probability

Trigger: If Wave C takes a bigger pullback (deeper retrace than Wave A)

Instead of contracting with tighter swings, the triangle expands with each leg getting larger. This would invalidate the running contracting count and suggest extended consolidation before the final breakout. Occurs when subsequent waves in the triangle are larger than previous legs – indicates more time/range needed before explosive move.

ALTERNATIVE 2: FLAT STRUCTURE (A-B-C) – 10% Probability

Trigger: If Wave C extends deeper than 0.618 Fib (4,325.336) with NO triangle pattern forming

Standard A-B-C flat instead of triangle. Would target 4,220-4,050 range. Requires breakdown of lower triangle support boundary to confirm.

📍 Key Levels & Triangle Boundaries

| LEVEL | PRICE | SIGNIFICANCE |

| Upper Triangle Boundary | 4,626.143 | Triangle upper line (Wave B high) – BREAKOUT ABOVE = Triangle complete |

| Current Price / Wave C | 4,547.00 | In contraction phase – HH/HL pattern active |

| Lower Triangle Boundary | ~4,300-4,325 | Triangle apex zone – Wave E should touch this area before breakout |

| Support (if triangle breaks) | 4,219-4,223 | Round level + previous pivot (invalidates running triangle) |

| UPSIDE TARGET (Post-Triangle) | 4,700+ (new ATH) | Triangle breakout target – measured move from apex |

💡 Trading Ideas

📈 PRIMARY TRADE (75% probability)

Setup: BUY breakout above 4,626.143 (upper triangle line)

Entry Zone: 4,626-4,650 (on close above triangle resistance)

Stop Loss: 4,300 (below triangle apex)

Target: 4,700 (primary) | 4,800+ (extended – new ATH)

Risk/Reward: 1:3 to 1:4 (excellent breakout setup)

Catalyst: Triangle E wave completes near 4,300-4,325, then explosive UP

📉 STOP-OUT TRADE (If triangle breaks)

Invalidation: Daily close BELOW 4,300 (lower triangle boundary) = flat structure likely

If occurs: SHORT target 4,220 → 4,050 (flat structure target)

Probability: 25% (Alt 1 + Alt 2 combined)

✅ Triangle Confluence Checklist

- ✓ HH/HL Pattern: Higher highs + higher lows confirmed (bullish contracting signature)

- ✓ Wave Subdivisions: Each triangle leg subdivides correctly into 3-wave structures

- ✓ Fibonacci Alignment: Wave C targets align with 0.618 Fib (4,325.336 apex zone)

- ✓ Volume Contraction: Triangle shows typical decreasing volume (compression)

- ✓ RSI Structure: Neutral 60-70 range (no overbought/oversold) – triangle signature

- ✓ 4H Intraday Wedge: Matches triangle apex zone (4H wedge = sub-wave of triangle E)

🎯 What’s Next: Triangle Completion Roadmap

- Days 1-5 (Near-term): Waves D-E compress toward apex (4556.435 zone)

- Triangle Breakout: Once Wave E touches apex, explosive breakout ABOVE 4,626 expected

- Post-Breakout Target: Measured move from apex = 4,700 → 5,100 (new all-time highs)

- Risk Case: If daily close below 4,300 = triangle invalidated, flat structure targets 4,050

📋 Summary for Traders

Macro Structure: Completed 5-wave impulse + running contracting triangle (Wave C) forming correction

Daily Bias: BULLISH – Triangle compression = prelude to explosive breakout (75% probability)

Key Signal: HH/HL pattern + apex zone 4,300-4,325 + upper boundary 4,626

Intraday Setup: 4H wedge compression = final triangle E wave (see intraday post for execution)

Action Plan: Wait for daily breakout above 4,626 OR daily close below 4,300 to confirm directional bias

Want to trade the apex zone on 4H?

View 4H Wedge Intraday Setup →⚠️ DISCLAIMER: This analysis is educational for Elliott Wave methodology. Running triangles are advanced patterns – not all analysts agree on classification. Trading carries substantial risk. Alternative scenarios provided for decision-making – not financial advice. Use proper risk management and stops.