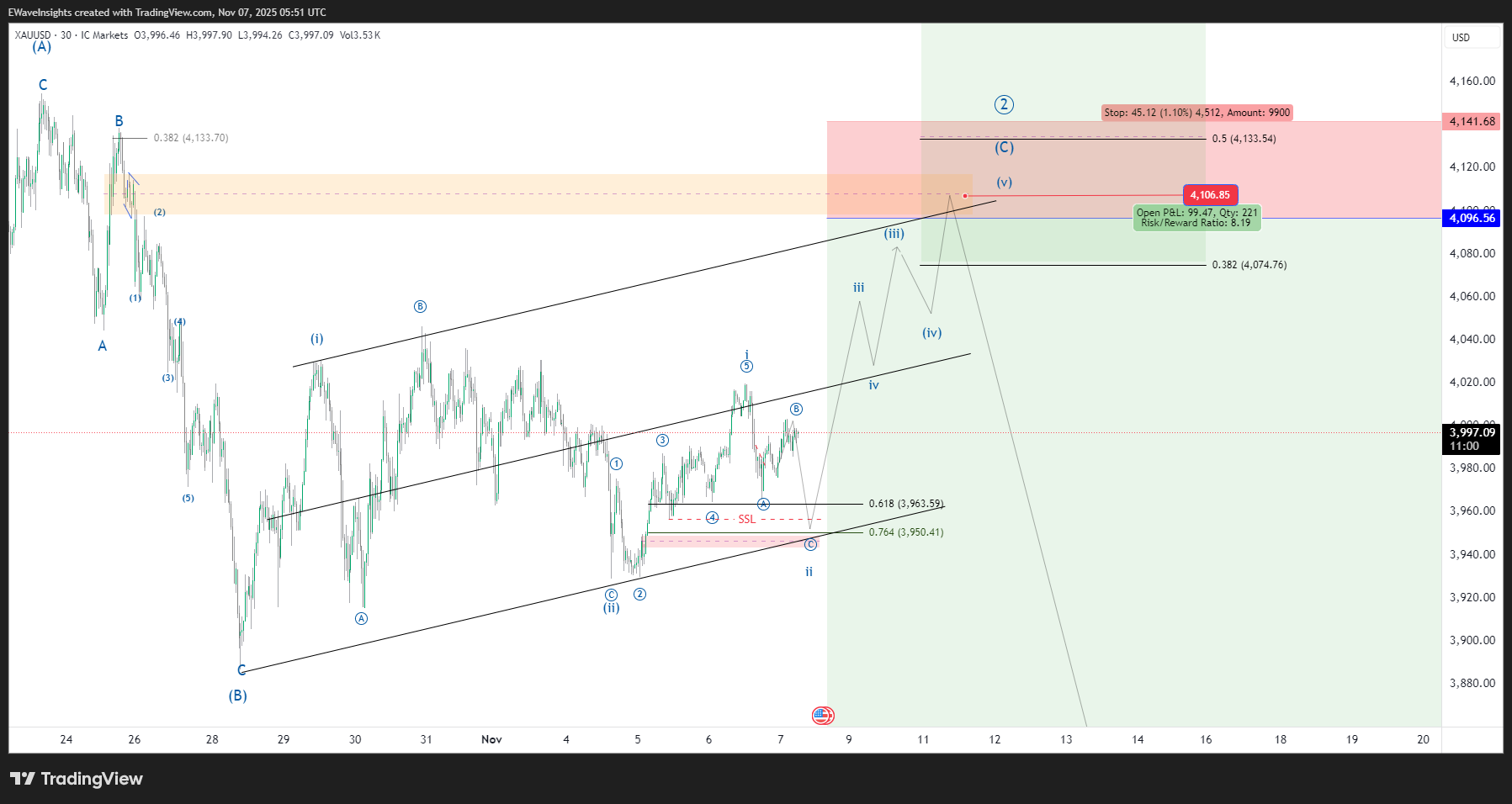

Gold (XAU/USD) Elliott Wave Analysis | Timeframe: 30-Minute Chart | Educational Purposes Only

Market Overview

Gold is currently developing a corrective wave structure on the 30-minute timeframe, presenting a multi-tiered trading opportunity that combines Elliott Wave Theory with institutional order flow concepts. The analysis reveals a classic flat correction pattern with potential for both short-term completion and extended wave scenarios.

Primary Elliott Wave Structure

Wave Pattern: Corrective (A-B-C) Flat Formation

The current price action shows a developing correction that began from higher levels and has established a clear A-B-C structure. The pattern presents two distinct scenarios based on how the correction unfolds:

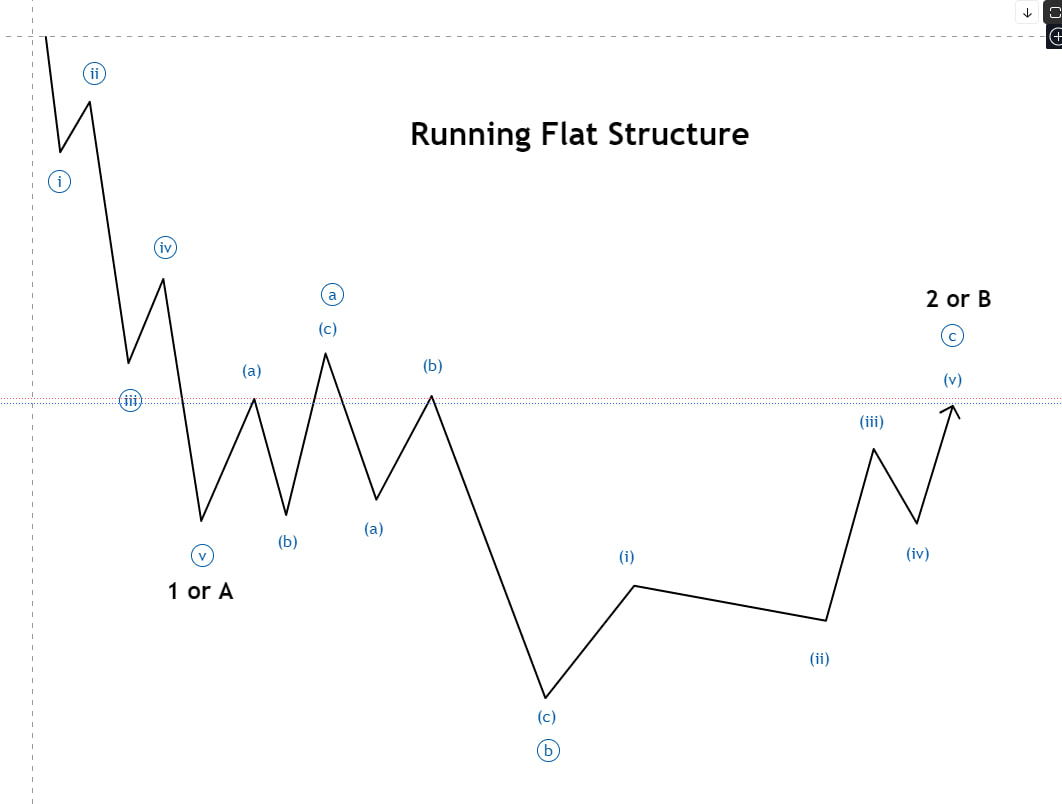

Scenario 1: Running Flat (Primary Count)

A running flat occurs when wave B reaches approximately the level of wave A, creating an efficient correction structure. In this scenario:

- Wave A completed at resistance levels

- Wave B is forming the consolidation phase

- Wave C is expected to complete near the 0.382 Fibonacci level at 4,076.47

- The correction maintains a tight, orderly structure

This pattern typically completes quickly and suggests a resumption of the prior uptrend.

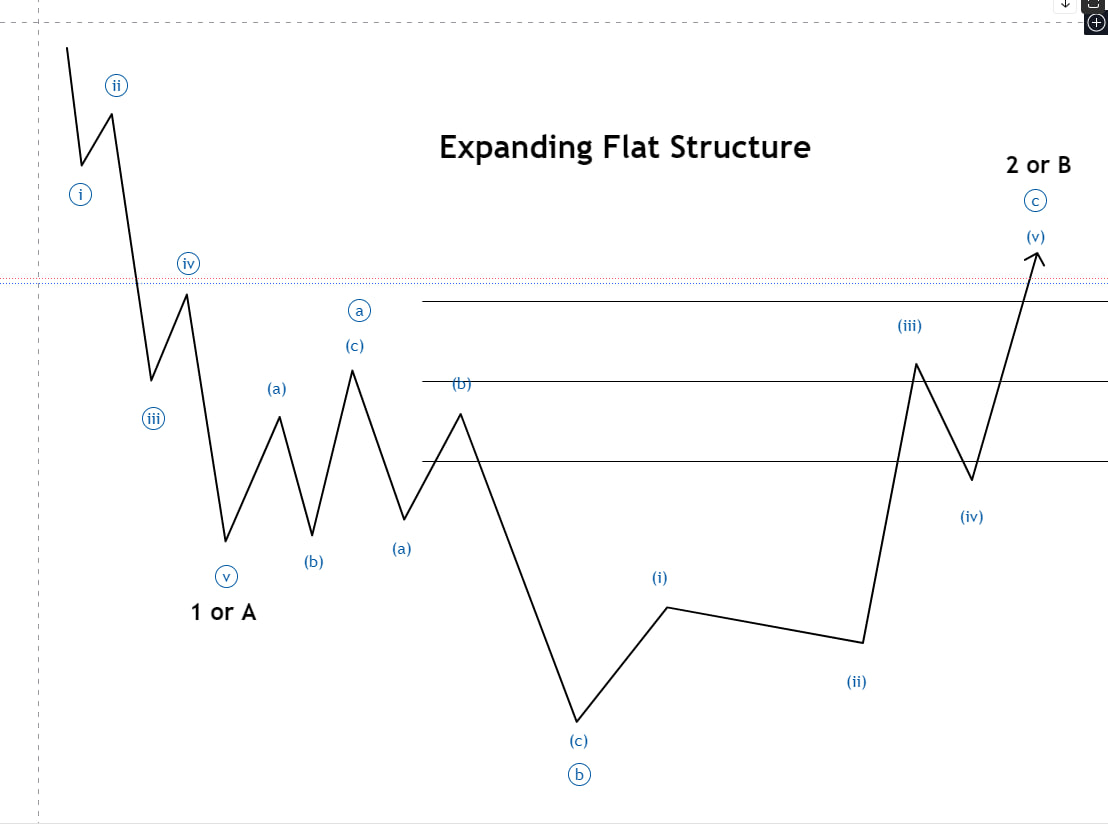

Scenario 2: Expanding Flat (Alternative)

If the market structure extends beyond typical parameters:

- Wave B exceeds the high of wave A

- Price could extend to the 0.618 Fibonacci level at 4192.01

- The correction becomes more volatile and broader in scope

- Still maintains bullish bias after completion

The key distinction is that expanding flats are more aggressive corrections but ultimately resolve in the same direction.

3

Trading Setup: Tier 1 (Short Entry)

Rationale:

The entry at 4,096.00 positions traders at a key consolidation zone where wave (C) is actively developing. This level provides an optimal balance between confirming the Elliott Wave structure and managing entry risk. The primary target of 3,725.54 represents an extended wave (C) completion point, with traders monitoring price action closely as this target approaches to adjust exits if necessary.

The stop loss at 4,141.48 provides tight risk control while remaining above critical structural support levels. However, traders should watch for price reaction in this area before entering, as the market may hold or break through these levels. If price closes significantly above 4,141.48, reassess the entire corrective wave count, indicating a potential shift in market structure and potentially invalidating the current setup.

Position Management:

- Confirm entry: Wait for price to show weakness at 4,096.00 (do not force entry)

- Monitor stops: Watch for reaction committing full position

- Scale entries: Consider entering in 2-3 tranches rather than all-in

- Manage flexibly: Adjust stops if price action suggests a different wave structure

Trading Setup: Tier 2 (Liquidity Sweep & Wave (ii) Bounce)

Understanding Sell-Side Liquidity

Above the 3,953.79 level, there exists institutional sell-side liquidity—areas where sellers have placed orders and stops. Professional traders understand that markets often move to capture this liquidity before reversing. This creates a high-probability reversal zone.

Long Entry After Liquidity Sweep

Liquidity Sweep Level: 3,953.79 (Fibonacci Confluence + Sell-Side Pool)

Wave Structure: Internal wave (ii) bounce within wave (C)

Trade Type: Swing reversal after institutional sweep

Target: Wave (iii) extension higher

How This Works:

- If wave (C) extends deeper than the primary target, price will likely sweep through 3,953.79

- This sweep captures stop-loss orders and institutional liquidity

- After the sweep, smart money enters long positions

- Price reverses sharply for wave (ii) bounce → wave (iii) impulse

- Internal wave (iii) can provide significant profit potential

Risk Management:

- Position size smaller than primary trade (this is a secondary opportunity)

- Stop loss placed below the swing low

- Take profits at 0.618 Fibonacci extension

- Only enter if liquidity sweep actually occurs

Elliott Wave Theory Applied

Understanding the Corrective Structure

Elliott Wave Theory teaches that markets move in five-wave impulses and three-wave corrections. A flat correction specifically refers to an A-B-C pattern where:

- Wave A: Declines in a 5-wave structure

- Wave B: Bounces significantly higher (typically 50-78.6% of wave A)

- Wave C: Declines again to complete the correction

The running and expanding variations depend on how wave B retraces wave A.

Why These Levels Matter

Fibonacci retracement levels (0.382, 0.5, 0.618, 0.764, etc.) are derived from mathematical ratios found throughout nature and markets. These levels act as magnet points where price often reverses or consolidates, reflecting areas of institutional order clustering and algorithmic support/resistance.

Risk Management Principles

Position Sizing:

- Risk only 1-2% of total account on any single trade

- Adjust position size based on distance to stop loss

- Smaller positions for extended scenarios (Tier 2)

Invalidation Levels:

- Primary invalidation: Close above 4,193.77 (cancels running flat count)

- Secondary invalidation: Close below 3,950 (may extend further)

- Always respect your predetermined invalidation; don’t “hope” price reverses

Trade Management:

- Partial profit-taking at primary targets (reduces risk)

- Trailing stops on extended positions (captures larger moves)

- Don’t let winners turn into losers (protect your capital first)

What to Watch For

Confirmation Signals:

- Bearish engulfing candles near 4,135-4,160 resistance

- Volume confirmation on the move toward 4,076.47

- Price holding above micro-support levels during the decline

- RSI divergence suggesting reversal potential

Warning Signs:

- Price closing above 4,193.77 invalidates the count

- Extended sideways consolidation instead of directional move

- Multiple failed attempts to break lower support

- Fundamental news events that shift market sentiment

Educational Takeaways

This setup demonstrates several key trading principles:

- Multi-Scenario Flexibility: Professional traders don’t have just one plan—they map multiple scenarios and adjust accordingly

- Confluence Zones: The strongest trading opportunities occur where multiple concepts align (Elliott Wave + Fibonacci + Liquidity)

- Risk/Reward Clarity: Before entering any trade, identify exact entry, target, and stop levels for precise risk management

- Institutional Order Flow: Understanding where smart money places orders (liquidity zones) reveals high-probability reversal points

- Patience and Discipline: The best trades often require waiting for specific confirmations rather than forcing entry prematurely

Current Market Status

As of November 6, 2025, gold is consolidating within the corrective structure with price action contained between 4,135-4,160. The path of least resistance appears downward, with the primary target of 4,076.47 acting as the next significant reference point.

Traders should monitor the behavior at resistance levels and watch for signs of wave (C) completion. The risk/reward ratio of 11.8:1 on the primary short setup makes this an attractive opportunity for disciplined traders following strict position management rules.

Disclaimer

This analysis is provided for educational and informational purposes only and should not be construed as financial advice or a recommendation to buy or sell any security. Past performance does not guarantee future results. Trading and investing involve substantial risk of loss. Always conduct your own research and consult with a financial advisor before making trading decisions. The strategies discussed carry significant risk and are not suitable for all traders.

Want Next Week’s Elliott Setups First?

Subscribe below to get premium analysis, early trade signals, and the latest strategy updates direct to your inbox.

Get Exclusive Updates

Already a member? Log in here | Free Discord Join our Discord room

Disclaimer