USD/JPY: Multi-Timeframe Elliott Wave Setup – From 4H to Weekly

This is a beautiful multi-timeframe structure. Let me walk you through the setup layer by layer.

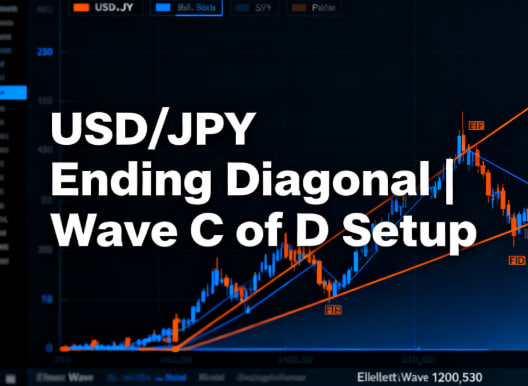

4-Hour Chart: Wave ((C)) of D – UsdJpy Ending Diagonal

The 4-hour shows the immediate action. We’re in the final wave of this corrective leg with an ending diagonal pattern (wave C of D). Notice the converging trendlines and overlapping waves – classic diagonal structure.

Key Points:

- Wave C of D looks nearly complete around current levels (154,452)

- The red dashed line is your confirmation trigger – a break below this line signals the ending diagonal is finished and we’re moving into pullback/wave E setup

- “Waiting for Break-Out” label shows we’re right at the edge

- Support zones marked: 0.618 (153.606), 0.382 (149.266), 0.5 (147.482)

What to watch: Break of the red dashed line = Wave C complete, pullback incoming.

Daily Chart: Full Wave D Structure

Zooming out to the daily, we see the complete wave D structure that contains the 4-hour action. This is the corrective triangle (wave D) within the larger wave 4.

Key Points:

- Wave A, B, C, D all visible in a triangle pattern

- We’re near D completion (which contains our 4-hour wave C)

- Wave E is the final leg of this correction coming next

- The triangle is converging toward E – which should be a smaller, final bounce

What this means: When the 4-hour breaks that red line, we get wave E on the daily. Wave E should be tight, contained, and smaller than the prior legs – classic triangle behavior.

Weekly Chart: Wave (4) – The Giant Triangle

Now pull back to the weekly, and you see the massive wave 4 correction that everything fits inside. This is the big picture context.

Structure:

- Wave A, B, C, D, E = the full wave 4 correction on the weekly

- We’re currently in D phase of this macro correction

- After D completes (after wave E on the daily), we get the powerful wave 5 impulse on the weekly

The Trade Setup:

- 4-hour: Wave C breaks red line → Pullback to 0.618 (153.606)

- Daily: Wave E unfolds → Smaller bounce in the E zone (151,000-143,000 range)

- Weekly: After E completes → Major impulse wave 5 begins with strong directional move

Why This Matters

This isn’t just a reversal. You’re watching a corrective structure complete at multiple timeframes simultaneously. When wave D finishes and wave E plays out, you’ll have:

- Confirmed structure (4-hour break + daily pattern completion)

- Clear pullback zones (Fibonacci levels marked)

- Setup for the strongest move (weekly wave 5 impulse incoming)

Trading Action: Wait for 4-hour red line break → Confirm pullback to daily support → Position for wave 5 breakout. This is where the money is.

Want Next Week’s Elliott Setups First?

Subscribe below to get premium analysis, early trade signals, and the latest strategy updates direct to your inbox.

Get Exclusive Updates

Already a member? Log in here | Free Discord Join our Discord room

Disclaimer