BTCUSD Elliott Wave Analysis continues to point toward a corrective consolidation within a larger secular uptrend rather than a completed bull market.

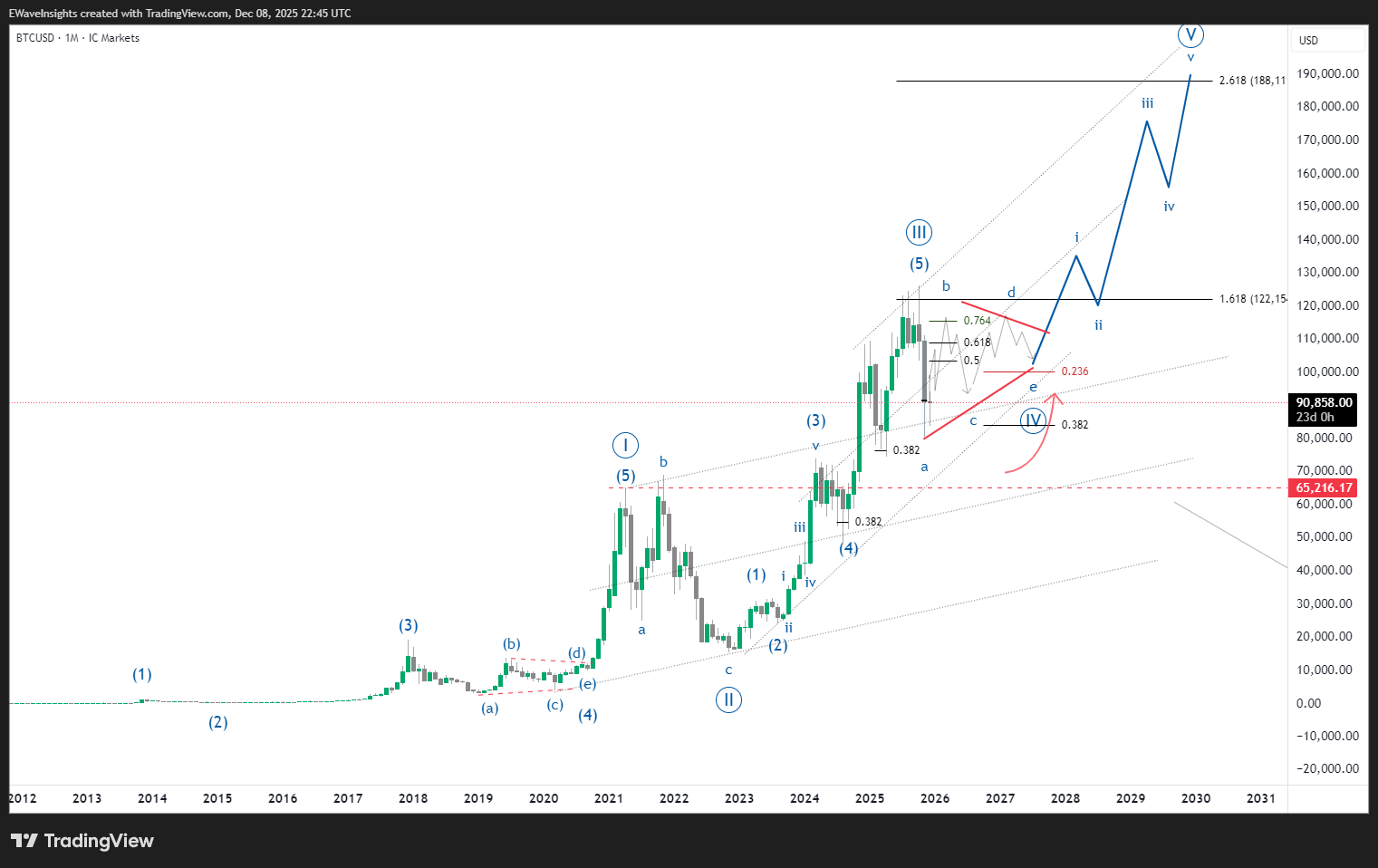

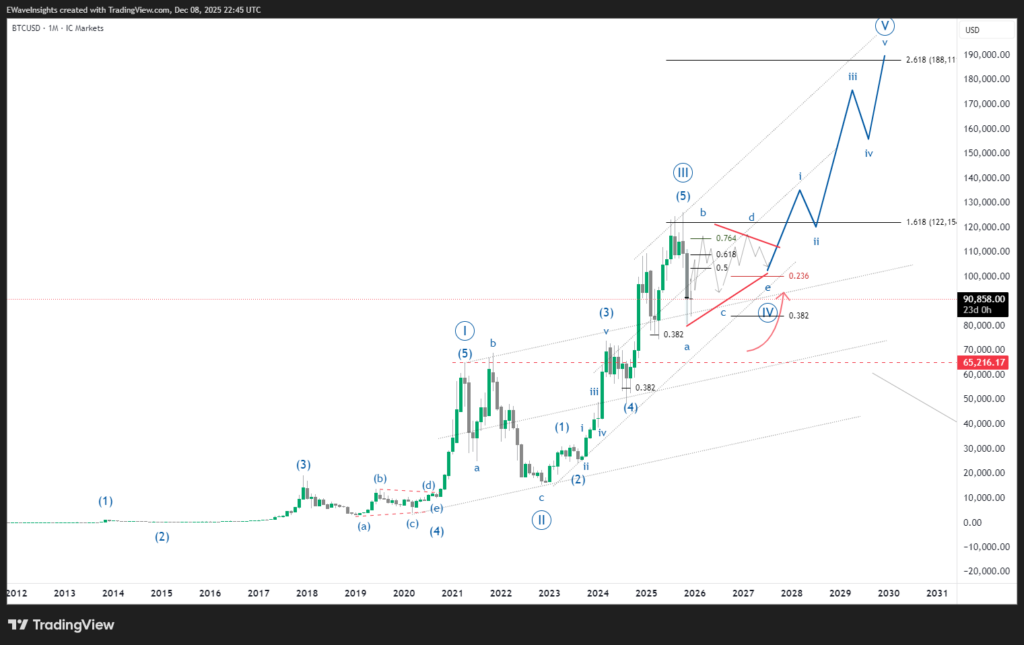

Big Picture Monthly Structure

On the monthly chart, BTCUSD appears to have completed a clear five‑wave advance into a major high, labeled as cycle wave III, with strong middle‑wave extension and momentum peaks aligning with the prior blow‑off phases. Price is now holding above the primary trend channel and oscillating around the 0.236–0.382 retracement band, a typical depth for a fourth‑wave correction in a strong, ongoing secular trend.

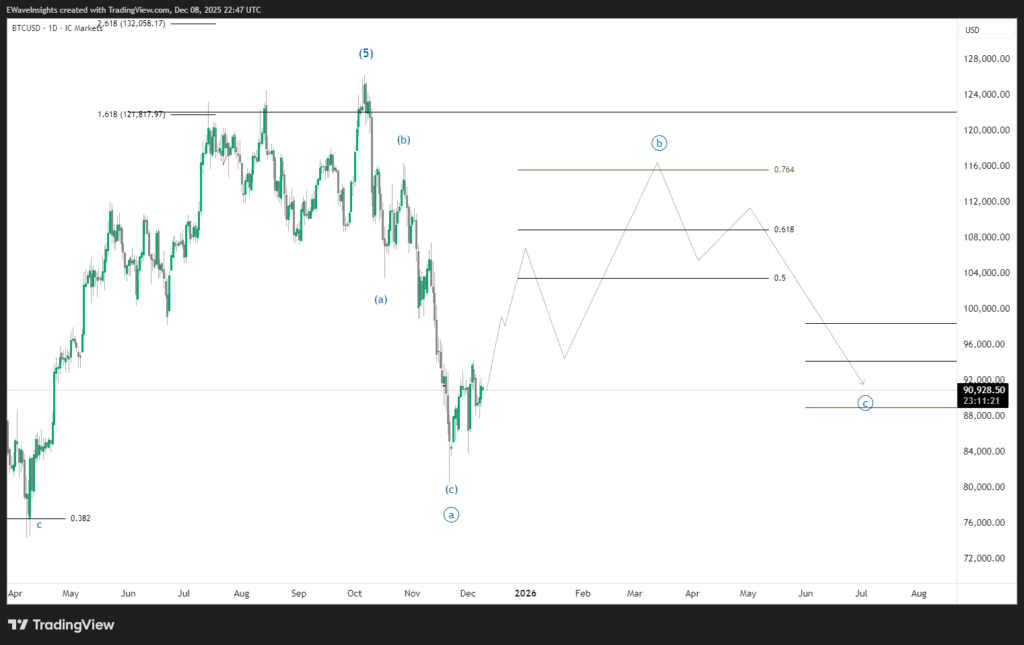

Developing Cycle IV Triangle

Within this higher‑degree context, current price action is best described as a developing cycle wave IV triangle. The first leg lower from the cycle III peak into the recent low counts well as wave a, followed by an overlapping, choppy recovery that is advancing toward the 0.5–0.764 retracement region for wave b. This structure aligns with common triangle characteristics: contracting price swings, loss of directional momentum, and internal corrective subwaves rather than impulsive pushes.

Key Levels and Invalidation

The key resistance zone for wave b sits in the 0.5–0.764 Fibonacci retracement band measured from the cycle III high to the wave a low, where reactions and slower upside progress would be expected if the triangle view is correct. On the downside, the major structural support is defined by the monthly 0.236–0.382 retracements and the lower boundary of the long‑term trend channel; holding above this cluster keeps the cycle IV triangle as the primary roadmap. A decisive sustained break below this band would be the clearest warning that the market is attempting a deeper correction than a typical fourth‑wave triangle.

Roadmap After Triangle Completion

If BTCUSD continues to trace out the remaining c–d–e swings inside the pattern, the expectation would be for volatility to compress further into mid‑range before cycle wave IV completes. Once a final e‑wave low forms without breaking the major support cluster, Elliott Wave guidelines anticipate a strong directional move in cycle wave V, with upside potential toward or beyond the upper parallel of the long‑term channel and Fibonacci extension targets measured from prior impulse legs.

The market leaves clues. Elliott Wave reads them.

1 thought on “BTCUSD Elliott Wave Analysis: Cycle Wave IV Triangle Before the Next Bull Leg”