THE FOUNDATION OF ACCURATE CHART ANALYSIS

INTRODUCTION

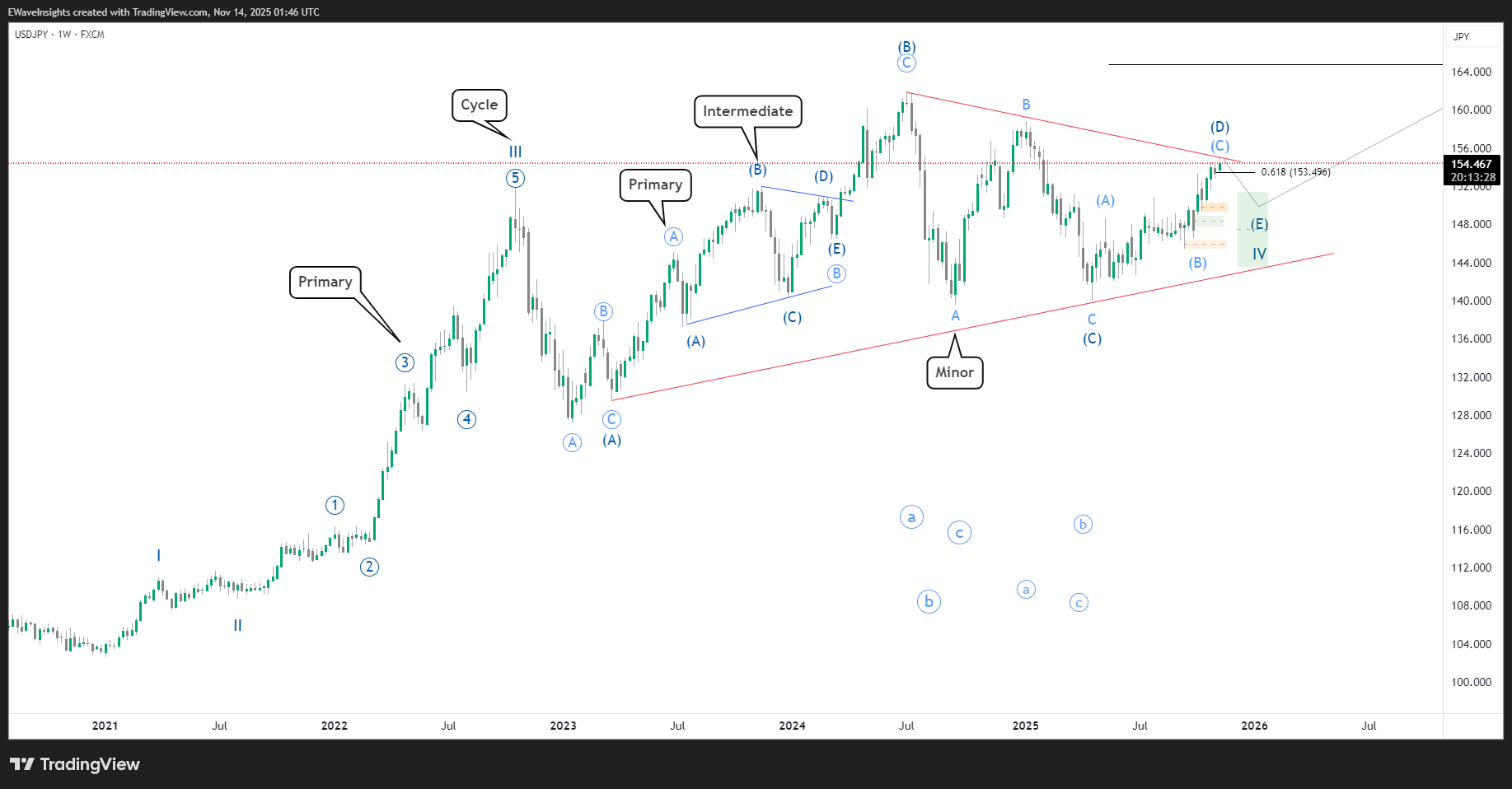

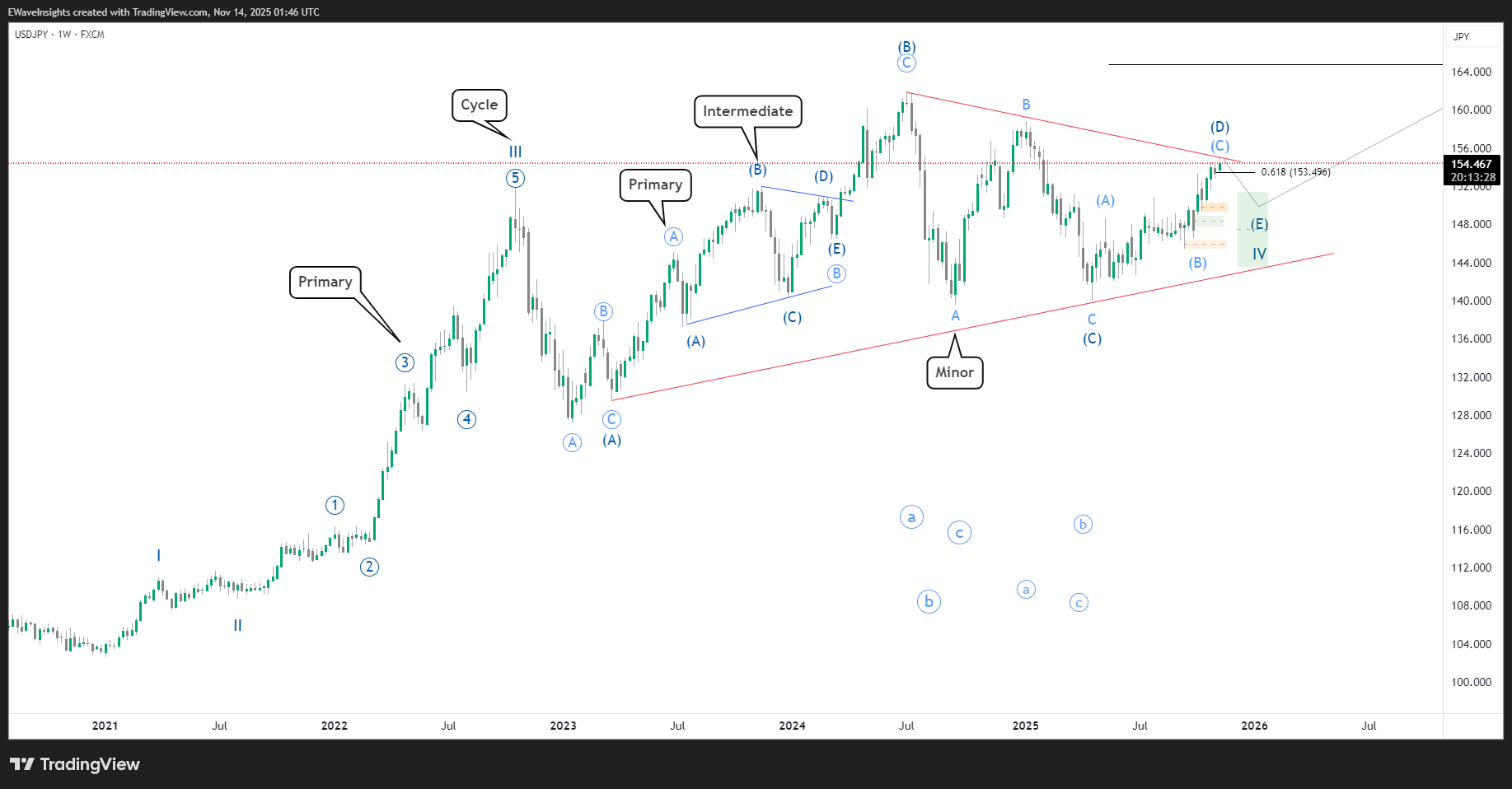

Most traders label waves incorrectly. They’ll identify a 5-wave structure on their daily chart and call it “Wave 3.” Then they move to the hourly chart and apply the same labels, creating confusion and lost trades.

The truth? Elliott Waves don’t exist in isolation. They nest within each other across multiple timeframes. Understanding Elliott Wave Degrees is what separates professionals from amateurs who guess their way through charts.

This isn’t a advanced concept. It’s foundational. And once you master it, every single Elliott Wave pattern becomes easier to identify.

WHAT ARE WAVE DEGREES?

Definition: Wave degrees are the hierarchical levels at which Elliott Wave structures occur. Every wave degree follows the same 5-3 structure—just at different timeframes.

Think of it like Russian nesting dolls. Your daily chart’s Wave 3 contains multiple hourly waves. Each hourly wave contains multiple minute waves. And each minute wave contains multiple minuette waves.

The pattern repeats infinitely.

This is the fractal nature of Elliott Waves, and it’s why you see the same structures repeating on every timeframe.

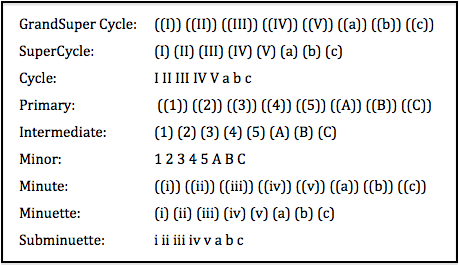

THE 9 WAVE DEGREES (LARGEST TO SMALLEST)

| Degree | Timeframe | Duration |

|---|---|---|

| Grand Supercycle | Generational | 40-80+ years |

| Supercycle | Multi-year | 7-15 years |

| Cycle | Yearly | 2-3 years |

| Primary | Multi-month | 3-12 months |

| Intermediate | Weekly/Monthly | 1-3 months |

| Minor | Weekly/Daily | 1-4 weeks |

| Minute | Daily/Hourly | 6-24 hours |

| Minuette | Hourly/Minutes | 15 mins – 2 hours |

| Sub-Minuette | Minutes/Seconds | Seconds – 15 minutes |

Key Point: Each degree uses the SAME labelling (1-2-3-4-5 for motive, A-B-C for corrective). The only difference is the timeframe.

WHY THIS MATTERS FOR TRADING

Multi-Timeframe Confirmation:

- Your daily chart shows a 5-wave Minor impulse

- Your hourly chart shows that same 5-wave pattern breaking into 5 Minute waves each

- Your 15-minute chart shows those patterns breaking into 5 Minuette waves each

When all three timeframes align in wave degree, your setup probability increases dramatically.

Example:

If you’re trading a daily Minor Wave 3:

- Entry: When Minute Wave 1 completes on the hourly chart

- Pyramid: As Minute Waves escalate during Minor Wave 3

- Exit: When Minute Wave 5 completes (signaling Minor Wave 3 completion is near)

This is how professionals trade with precision. They’re not guessing—they’re reading nested structures.

CORRECT LABELLING RULES

Rule 1: Motive Waves = Always 1-2-3-4-5

Never label them as repeating: 1-2-1-2-1. The numbers represent progression through the structure, not cyclical repetition.

✓ Correct: Wave 1 → Wave 2 → Wave 3 → Wave 4 → Wave 5

✗ Incorrect: Wave 1 → Wave 2 → Wave 1 → Wave 2 → Wave 1

Rule 2: Corrective Waves = Always A-B-C

These must follow the corrective pattern. If it doesn’t fit, it hasn’t completed yet.

✓ Correct: Wave A → Wave B → Wave C (zigzag, flat, or triangle)

✗ Incorrect: Wave A → Wave B (waiting for Wave C before labelling complete)

- Why Rule 2 Emphasizes A-B-C:

Rule 2 highlights that the fundamental building block of corrective structures is the A-B-C pattern. Even complex corrections are made up of multiple A-B-C sections. Therefore, when labelling charts, one must ensure each section is a complete A-B-C before moving on to the next. - Incomplete Labels:

Labeling a correction as just Waves A and B is premature until Wave C fully develops to complete that segment. This caution helps prevent misidentifying ongoing corrective movements that remain unfinished.

This rule does not deny the existence of complex corrections but enforces clarity and completeness when identifying parts of them.

Rule 3: Degree Consistency Within Timeframe

Choose ONE timeframe and stick with one degree level for that chart.

✓ Correct:

- Daily chart = Minor/Intermediate degree

- Hourly chart = Minute degree

- 15-min chart = Minuette degree

✗ Incorrect:

- Mixing degrees (calling some Minute, others Minor on the same daily chart)

- Jumping degrees inconsistently

Why Mixing or Jumping Degrees Is Wrong

- Mixing degrees (for example, labeling some waves as “Minute” and others as “Minor” on the same timeframe) leads to confusion and inconsistencies. Each degree (like Primary, Intermediate, Minor, Minute, etc.) should be used in a strict, logical sequence. On any given chart, if you label one wave “Minor,” all other waves of that rank must also use “Minor”—don’t jump around or swap terms between swings.

- Jumping degrees inconsistently means skipping logical wave degrees or flipping between ranks. For example, labeling a move as “Minute” and then its next subdivision as “Primary” is inconsistent (Minute is a smaller scale than Primary). You must always step up or down the degree sequence properly: Primary → Intermediate → Minor → Minute → Minuette, etc.

Rule 4: Larger Degree = Larger Structure

A Cycle degree wave is MUCH larger than a Minor degree wave. You can’t label a 2-day move as “Cycle” degree when your context is multi-year trends.

COMMON LABELLING MISTAKES (AND HOW TO FIX THEM)

Mistake #1: Forcing Structure Before Completion

❌ You see 3 waves and immediately call them A-B-C before Wave C finishes

✅ Wait for completion signals (Wave C closes below Wave A, or completes the pattern structure)

Mistake #2: Mislabeling Wave 4/Wave 2

❌ You see a pullback and call it Wave 4, even though it violates Wave 4 rules

✅ Verify Wave 4 does NOT overlap into Wave 1 price territory before labeling

Mistake #3: Inconsistent Degrees Across Charts

❌ You call daily waves “Minor” but hourly waves “Intermediate”

✅ Maintain consistent hierarchy (if daily is Minor, hourly is Minute)

Mistake #4: Confusing Retracements with Completions

❌ A 38% retracement looks “complete” but it’s just a shallow correction

✅ Wait for full structure completion, not just retracement targets

MULTI-TIMEFRAME LABELLING WORKFLOW

Step 1: Choose Your Primary Timeframe

(e.g., Daily chart)

Step 2: Identify Degree

(Minor = daily, Minute = hourly, Minuette = 15-min)

Step 3: Label Current Structure

(1-2-3-4-5 or A-B-C based on direction)

Step 4: Drop Down to Next Smaller Timeframe

(Hourly chart to label Minute degree)

Step 5: Use Smaller Degree for Entry/Exit Precision

(Trade Minute waves WITHIN Minor wave movements)

Step 6: Return to Primary Timeframe for Confirmation

(Verify larger degree structure supports smaller degree moves)

KEY TAKEAWAYS

✓ Wave degrees explain the fractal structure of all markets

✓ 9 degrees from Grand Supercycle down to Sub-Minuette

✓ Same labelling (1-2-3-4-5 / A-B-C) applies to ALL degrees

✓ Multi-timeframe alignment = higher probability setups

✓ Consistent degree naming prevents confusion

✓ Smaller degrees provide entry/exit precision

✓ Larger degrees provide trend confirmation