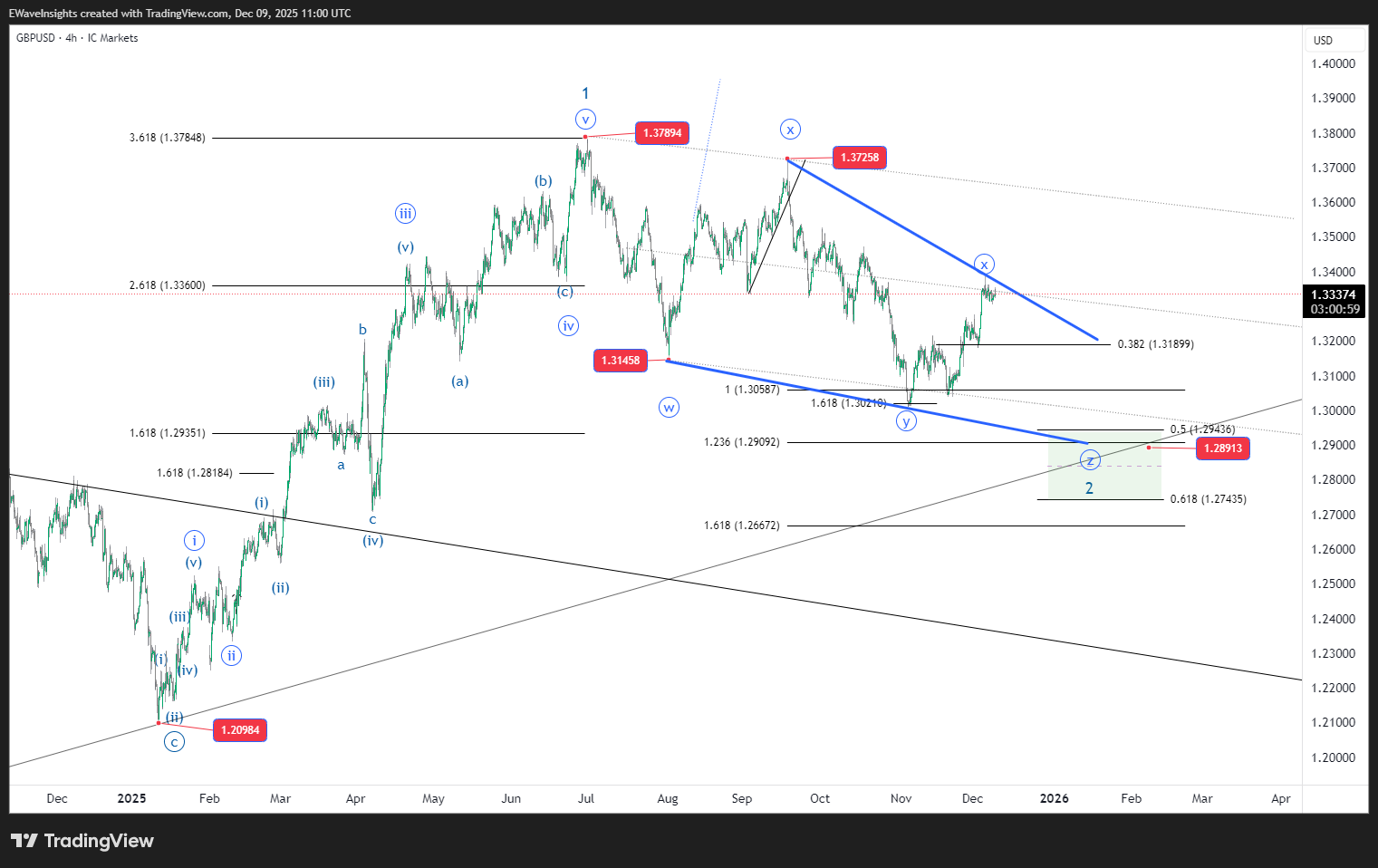

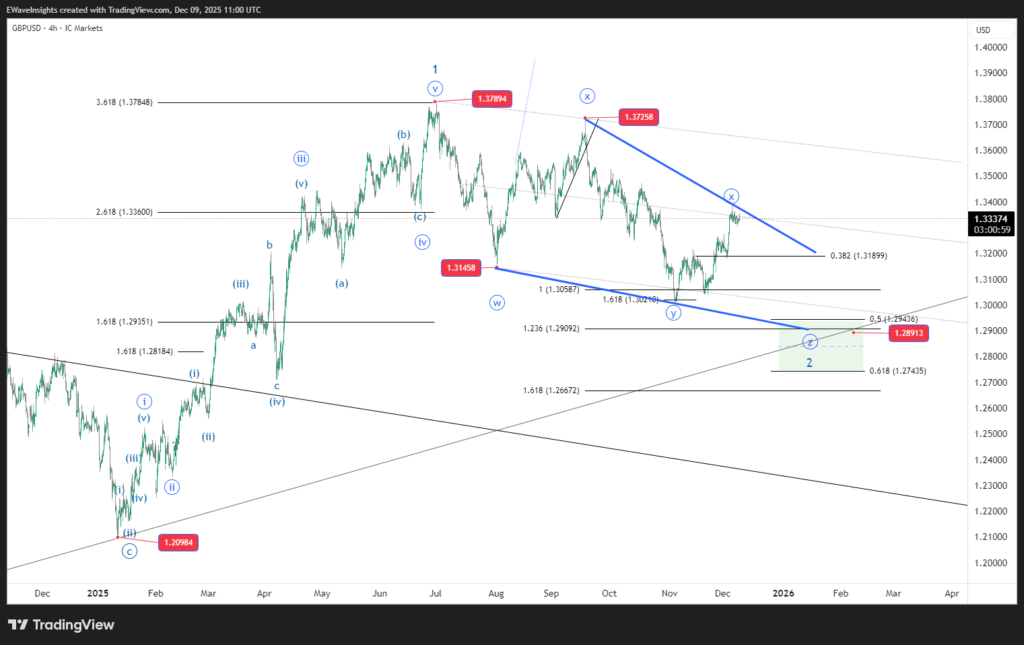

GBPUSD Elliott Wave Analysis continues to favour a bullish higher‑timeframe roadmap, with price currently working through what looks like a higher‑degree Wave 2 correction after the impulsive advance from the 1.21 area into the 1.37s. The decline from the Wave 1 high into 1.3145 forms the first leg of the correction (w), followed by an overlapping recovery into 1.3725 as x, and price now appears to be developing the final zigzag down in y toward the 1.29–1.28 support region highlighted on the chart.

Key Levels

The primary Wave‑2 downside zone spans from roughly 1.2930, which aligns with the 0.5 retracement of the prior advance, down to around 1.2740, where the 0.618 retracement comes in. The 1.29 handle sits in the middle of this cluster and also coincides with a 1.618 Fibonacci projection of the earlier swing, creating a strong confluence area for a corrective low. As long as GBPUSD holds above the wider 1.2660–1.27 region, the larger impulsive structure from 1.21 remains intact and this correction is still best viewed as Wave 2 rather than the start of a more bearish sequence.

Elliott Wave Roadmap

The preferred roadmap is for price to fade lower from the current descending channel resistance (blue trendline) and complete Wave 2 inside the 1.29–1.28 support box before a fresh Wave 3 advance has room to develop. While that zone has not yet been tested, pops within the channel are treated as corrective rallies, not yet the beginning of Wave 3. Once the boxed area is tagged and defended ideally with evidence of impulsive buying and improving momentum the focus shifts to confirming that Wave 3 is underway, with higher‑timeframe targets then projected using standard Fibonacci extensions of Wave 1.