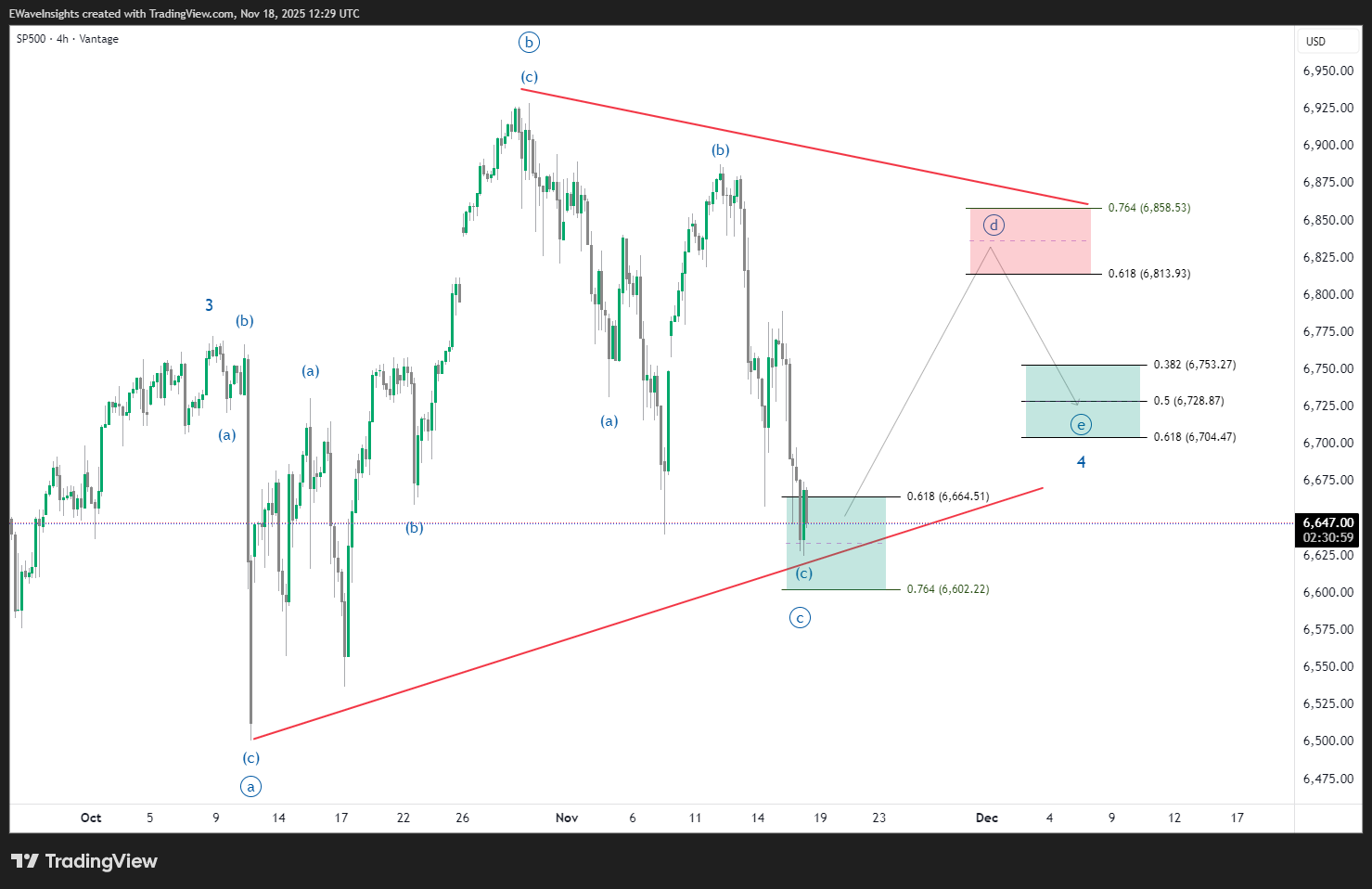

SP500 Analysis: Elliott Wave Flat Correction Sets Up Bullish Opportunity

Update (November 18):

I’ve attached an updated chart for the ongoing SP500 analysis. Upon review, wave C was marked incorrectly in my previous post. Wave B actually formed an expanding flat, which shifted the structural context of the triangle. With wave C now potentially in place along the lower support boundary, the expectation is for further sideways consolidation as wave D develops—possibly extending throughout November.

Given that wave B unfolded as an expanding flat, the triangle remains the dominant scenario as long as price respects the established red trendlines. If wave D develops as expected, resistance is likely in the 6,814–6,858 region a potential area for a reversal or at least a pause in upward momentum. Should resistance hold, a rejection from this zone could set up a subsequent move lower into the primary wave E target zone below 6,753, as highlighted by the updated Fibonacci levels. This evolving pattern underscores the need to remain adaptive with Elliott Wave counts as new market evidence and price swings continue to emerge.