AUDJPY – Short-term Bearish Outlook

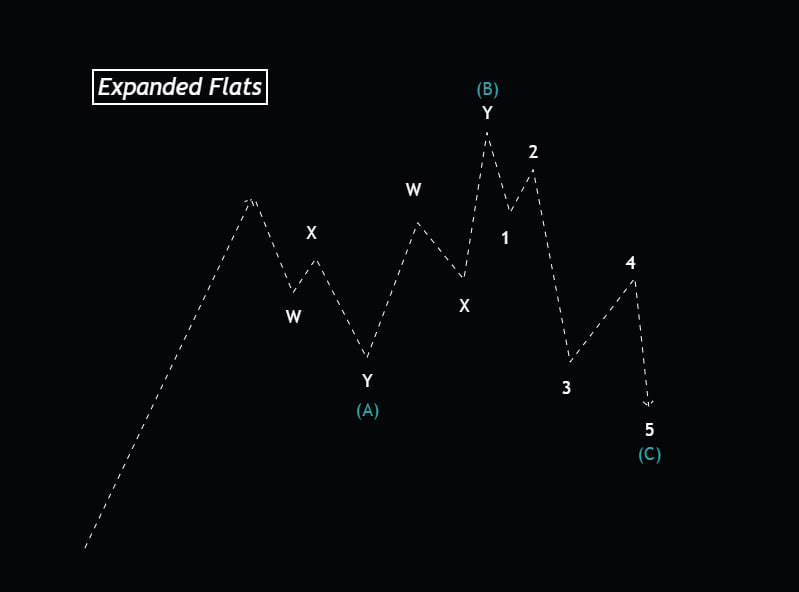

Price has completed a strong advance and is now showing corrective, overlapping behaviour 📉, suggesting the impulsive move is likely complete. The current pullback is being treated as a developing wave ii, with the preferred interpretation being a flat structure 🔄. At this stage, patience is required ⏳. Rather than anticipating continuation, the focus is on allowing wave ii to fully form, which … Read more