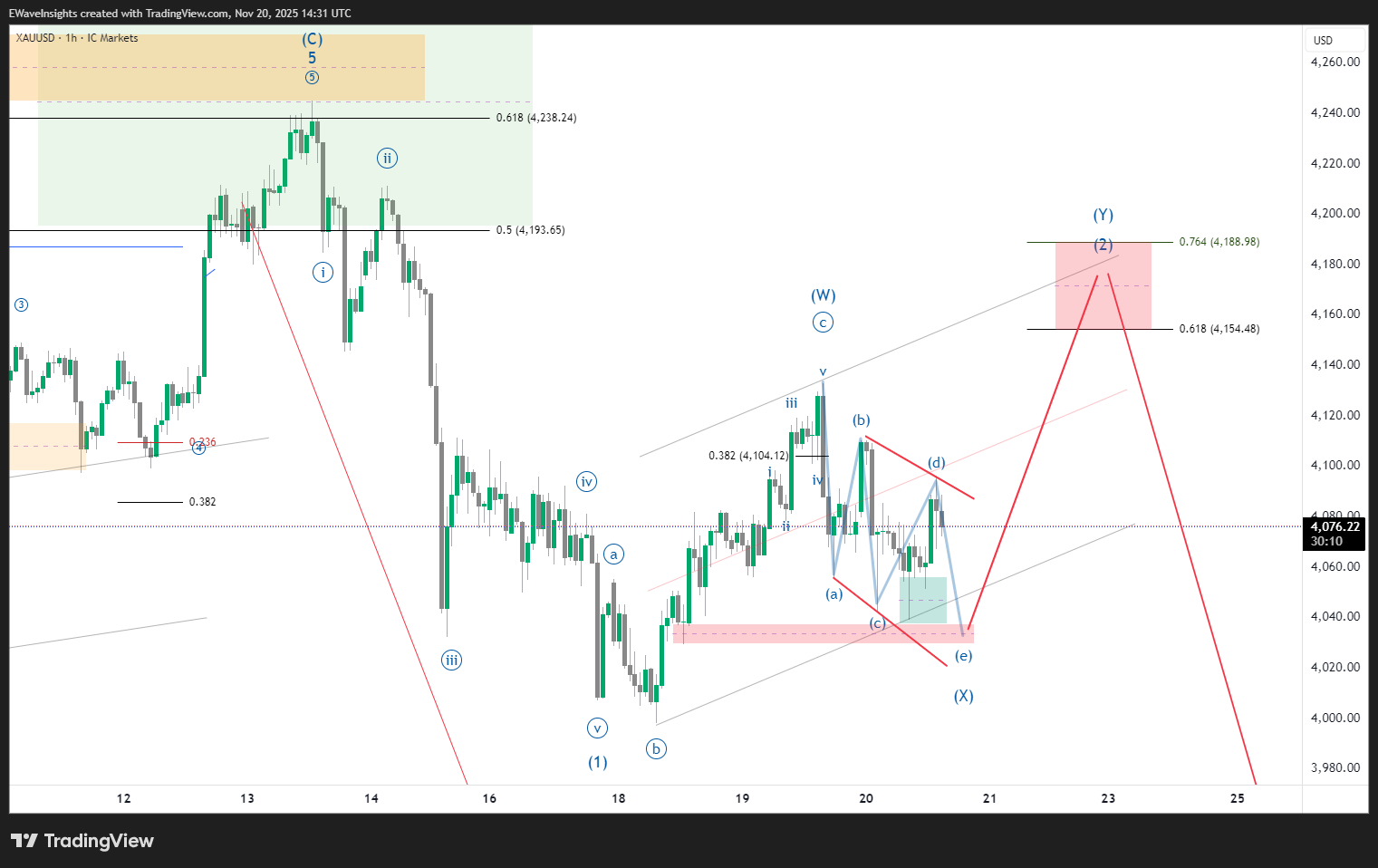

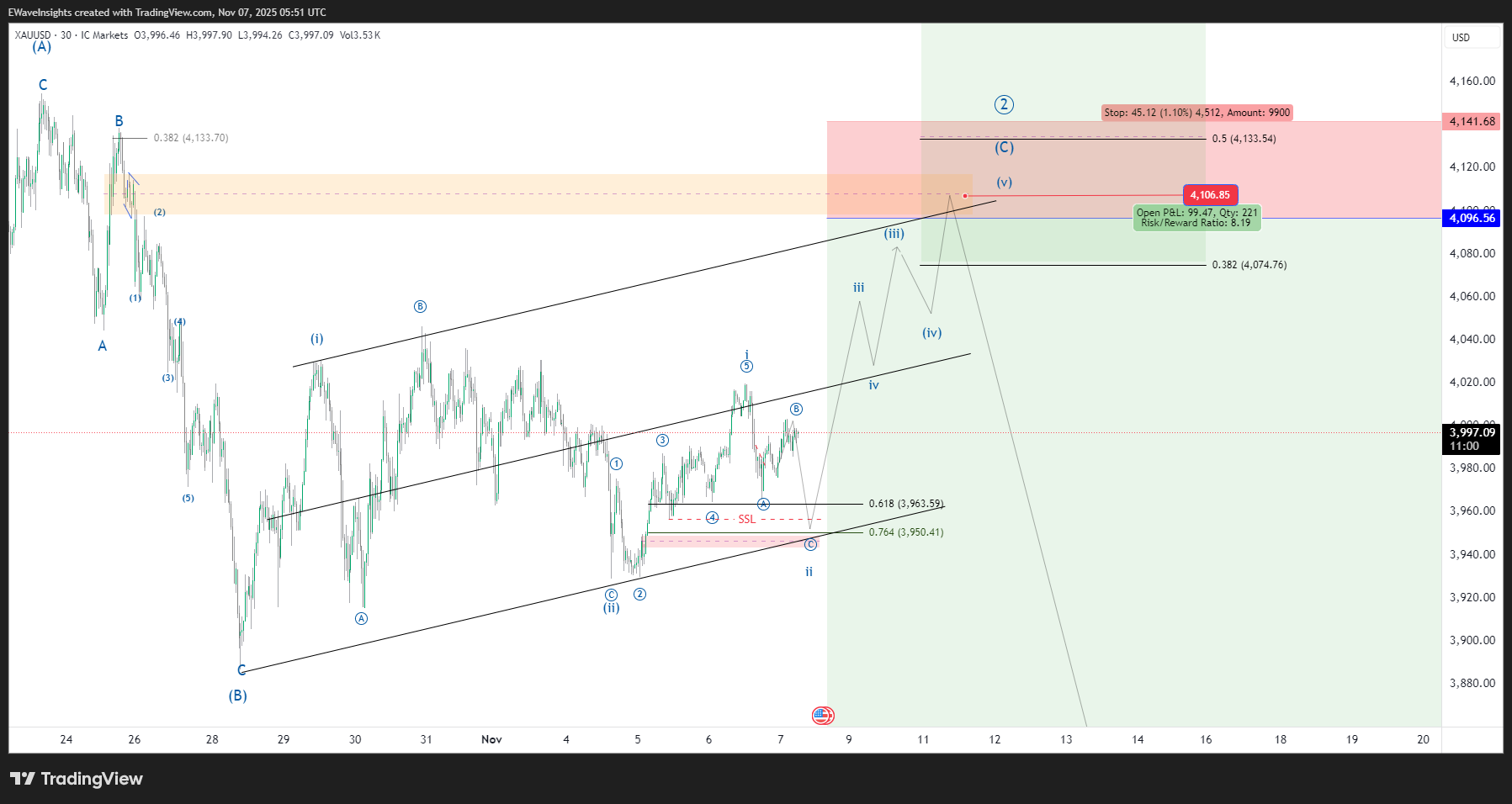

📊 XAUUSD DAILY MARKET ANALYSIS

📊 XAUUSD DAILY MARKET ANALYSIS January 6, 2026 | Daily Timeframe | Running Contracting Triangle 🎯 Market Overview Instrument:XAUUSD (Gold) Timeframe:Daily (1D) Current Price:4,547.00 Macro Trend:Bullish (Triangle compression phase) 📈 PRIMARY COUNT – RUNNING CONTRACTING TRIANGLE Pattern: Running Contracting Triangle (Wave C leg) Structure: Waves I-II-III-IV-V (completed) → Corrective A-B in place → Triangle forming … Read more