Flat Correction Elliott Wave: Complete Guide with Fibonacci Levels & Trading Rules

Master sideways Elliott Wave corrections with professional analysis, Fibonacci extensions, and proven trading strategies

🎯 Flat Correction Structure Breakdown:

| Wave Component | Wave Structure | Trading Implication |

| Wave A | 3-wave sideways pattern (initial correction) | Establishes correction support level – signals consolidation beginning |

| Wave B | 3-wave deep retracement (90-110% of Wave A) | Deep bounce – indicates strong underlying trend will continue |

| Wave C | 5-wave extension move (1.272, 1.618 × Wave A) | Final corrective wave – confirms flat completion and trend resumption |

📐 Fibonacci Relationships & Guidelines:

✓ Wave A to Wave B Relationship (Retracement Rule):

| Flat Type | Wave B Retraces | Wave B / Wave A Ratio | Market Signal |

| Regular Flat | 90-100% of Wave A | 0.90 – 1.00 | Conservative consolidation |

| Expanded Flat | 105-125% of Wave A (BREAKS PRIOR SUPPORT) | 1.05 – 1.25 | Strong trend continuation signal |

| Running Flat | >125% of Wave A (EXTREME RETRACEMENT) | >1.25 | Extremely strong underlying trend |

✓ Wave A to Wave C Relationship (Extension Rule):

| Fibonacci Level | Wave C Target | Calculation | Probability |

| 0.618 Extension | SHALLOW TARGET | Wave A × 0.618 | 5% (Rare) |

| 1.000 Extension | EQUAL WAVE (100% = Wave A) | Wave A × 1.000 | 15% |

| 1.236 Extension | COMMON TARGET 🎯 | Wave A × 1.236 | 25% (Popular) |

| 1.382 Extension | MODERATE TARGET | Wave A × 1.382 | 20% |

| 1.618 Extension | PRIMARY TARGET 🎯🎯 | Wave A × 1.618 | 30% (Most Common) |

| 2.000 Extension | EXTENDED TARGET | Wave A × 2.000 | 5% |

| 2.618 Extension | AGGRESSIVE TARGET | Wave A × 2.618 | Rare (Extreme) |

✓ Inter-Wave Relationships (Advanced Guidelines):

Wave B = 0.236 to 0.382 of Wave A

Internal correction within Wave B – shallow pullback within flat structure (GUIDELINE: not a rule)

Wave C = Wave A × Fibonacci (0.618, 1.000, 1.236, 1.382, 1.618, 2.618)

Most reliable guideline – Wave C typically equals one of these ratios of Wave A length (RULE: Primary targets 1.236-1.618)

Time Relationship Guideline: Wave C Duration ≈ Wave A Duration

Less precise than Fibonacci ratios, but waves often take similar time to unfold (use for confirmation)

⚠️ Why Flat Corrections Matter: Flat corrections are sideways consolidations, NOT sharp pullbacks like zigzags. Wave B retraces 90-110% of Wave A, which catches many traders off-guard expecting a shallow bounce. Use the 1.272-1.618 Fibonacci extension levels to anticipate Wave C targets and prepare for trend continuation after flat correction completion. Flats indicate balance between buyers and sellers before the next directional move.

⚙️ Three Types of Flat Corrections:

1. Regular Flat (Conservative)

Pattern: Wave B retraces ~90-100% of Wave A | Wave C ends near Wave A start level

Fib Relationship: Wave C typically = 1.000 to 1.236 × Wave A

✓ Lower volatility | ✓ Clear support/resistance setup | ✓ Moderate trend continuation expected

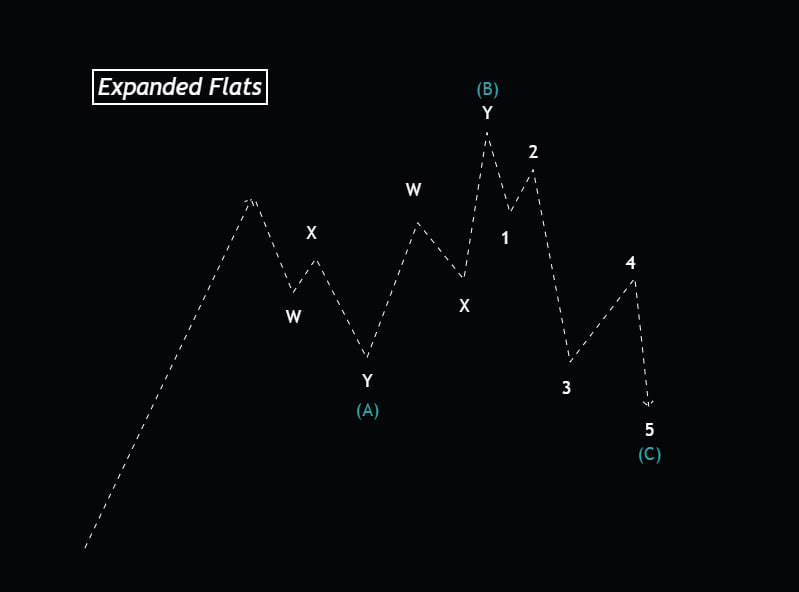

2. Expanded Flat (Most Common) 🎯

Pattern: Wave B exceeds Wave A start (105-125%) | Wave C extends 1.618× Wave A

Fib Relationship: Wave C typically = 1.236 to 1.618 × Wave A (MOST RELIABLE)

✓ Higher volatility | ✓ Breaks support levels | ✓ Strong trend continuation signal

3. Running Flat (Rare – Extreme Trend)

Pattern: Wave B far exceeds Wave A | Wave C fails to reach Wave A end

Fib Relationship: Wave C = 0.618 to 1.000 × Wave A (STOPS EARLY)

⚠️ Indicates extremely strong directional trend | ⚠️ Minimal correction before move resumes

📍 Flat Correction vs Zigzag Comparison:

| Aspect | Flat Correction | Zigzag Correction |

| Structure | SIDEWAYS (A-B-C) | SHARP DOWN (A-B-C) |

| Wave B Retracement | 90-110% of Wave A (DEEP) | 50-60% of Wave A (SHALLOW) |

| Wave B Fib Ratio | 0.90-1.25 (or higher for running) | 0.50-0.618 |

| Wave C Target | 1.236-1.618 × Wave A | 1.236-1.618 × Wave A |

| Volatility | MODERATE to HIGH | SHARP & QUICK |

| Market Signal | CONSOLIDATION (Trend continues) | CORRECTION (Sharp pullback) |

✅ Pro Trading Tips for Flat Corrections:

• Identify Wave A completion early – watch for a reversal from the primary trend

• Set stops ABOVE Wave B high (use 90-110% of Wave A as guideline) – flat corrections pierce deep

• Calculate Wave C targets using 1.236-1.618 Fibonacci extensions of Wave A (primary targets)

• Enter Wave C longs when price bounces from Wave B completion zone (90-125% of Wave A)

• Confirm flat with break below Wave A level = Wave C completion, trend resumes

• Use expanded flat pattern (Wave B = 1.05-1.25 × Wave A) as strongest trend continuation signal

📚 Related Elliott Wave Patterns

XAUUSD Zigzag Pattern – Wave C Extension Levels

Learn sharp Elliott Wave zigzag corrections with Wave C extensions (1.236, 1.618, 2.618). Understand shallow Wave B retracement (50-60%), sharp corrective moves, and how zigzags differ from flat patterns for effective trading.

Follow Elliott Wave Insights

Get real-time Elliott Wave analysis, trading setups, and market insights delivered daily.